In-house legal teams increasingly play a critical role in safeguarding not only legal compliance but also the financial health of an organization. Contracts directly affect revenue recognition, cost structures, tax exposure, penalties, and cash flow timing. However, financial risks embedded in legal documents are often overlooked due to time constraints, fragmented contract data, and manual review processes. Notebook LM addresses these challenges by integrating AI-powered legal document review with a strong focus on finance-related risk and control.

From a financial perspective, one of the most significant pain points is the difficulty in quickly identifying clauses that have direct monetary impact. Payment terms, pricing mechanisms, penalties, termination fees, limitation of liability, and indemnification provisions are frequently buried in lengthy agreements. Notebook LM automatically extracts and summarizes these clauses, enabling legal and finance teams to assess financial exposure at an early stage. This reduces the risk of unfavorable terms being approved under commercial pressure and strengthens internal financial governance.

Notebook LM also supports better cash flow and revenue management. By clearly identifying payment schedules, milestone-based billing, late payment interest, and refund conditions, the platform allows finance teams to align contractual obligations with accounting and treasury planning. For long-term or complex agreements, AI-driven summaries help ensure that revenue recognition and cost allocation are consistent with contractual terms, supporting compliance with accounting standards and internal policies.

Penalty clauses and termination provisions represent another area of significant financial risk. Notebook LM highlights early termination rights, liquidated damages, and penalty triggers, allowing organizations to quantify potential financial exposure before contracts are executed. This insight is particularly valuable during negotiations, where legal and finance teams can work together to mitigate downside risk and protect margins.

Beyond individual contracts, Notebook LM enhances financial oversight at a portfolio level. Centralized contract data enables organizations to track renewal dates, pricing adjustments, and financial commitments across hundreds or thousands of agreements. This visibility supports more accurate budgeting, forecasting, and audit readiness, while reducing reliance on manual spreadsheets and fragmented records.

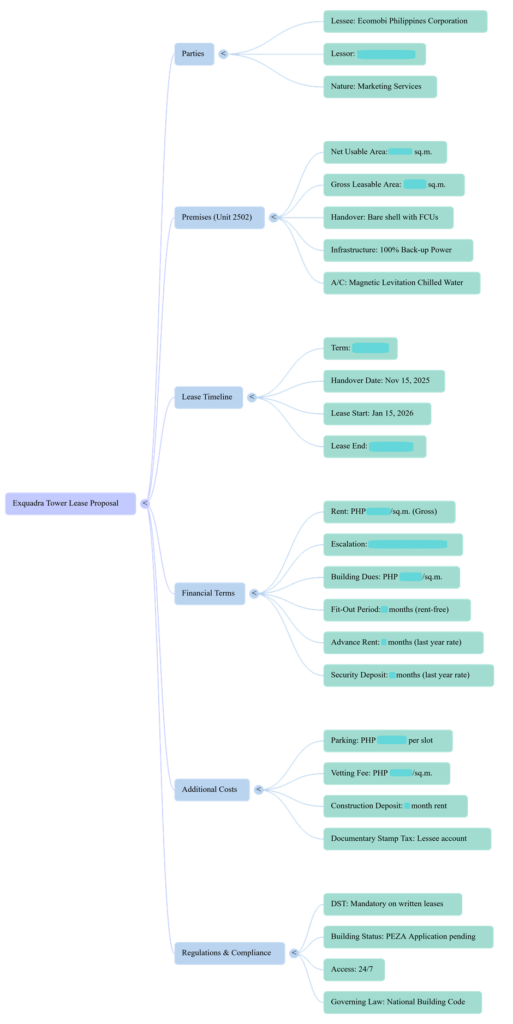

Based on practical experience, Notebook LM also provides significant value during the contract discussion and review process through its interactive question-and-answer capabilities. Legal and finance professionals can engage directly with contract content by asking targeted questions and receiving concise, context-aware responses. In addition, Notebook LM can generate structured summaries, audio, video, reports and visual mind maps that illustrate key contractual concepts, financial obligations, and risk areas, making complex agreements easier to interpret and communicate to stakeholders.

These capabilities are particularly effective for long and complex contracts, where critical financial and legal provisions are often dispersed across multiple sections. By improving information accessibility and comprehension, Notebook LM can reduce overall contract review time by approximately 30%, while maintaining a high level of accuracy and risk awareness. This efficiency gain enables in-house legal and finance teams to focus more on negotiation strategy, financial impact assessment, and decision-making rather than manual document analysis.

Illustration for NotebookLM visualization (Sensitive information has been concealed for confidentiality purposes)

In practice, Notebook LM strengthens collaboration between legal, finance, and business teams. Legal professionals gain a clearer understanding of the financial implications of contractual terms, while finance teams benefit from faster access to reliable contract data. For management, this translates into improved decision-making based on transparent, contract-driven financial insights.

By embedding financial intelligence into legal document review and contract management, Notebook LM helps organizations move from reactive risk mitigation to proactive financial control—ensuring that contracts support both legal compliance and sustainable financial performance.